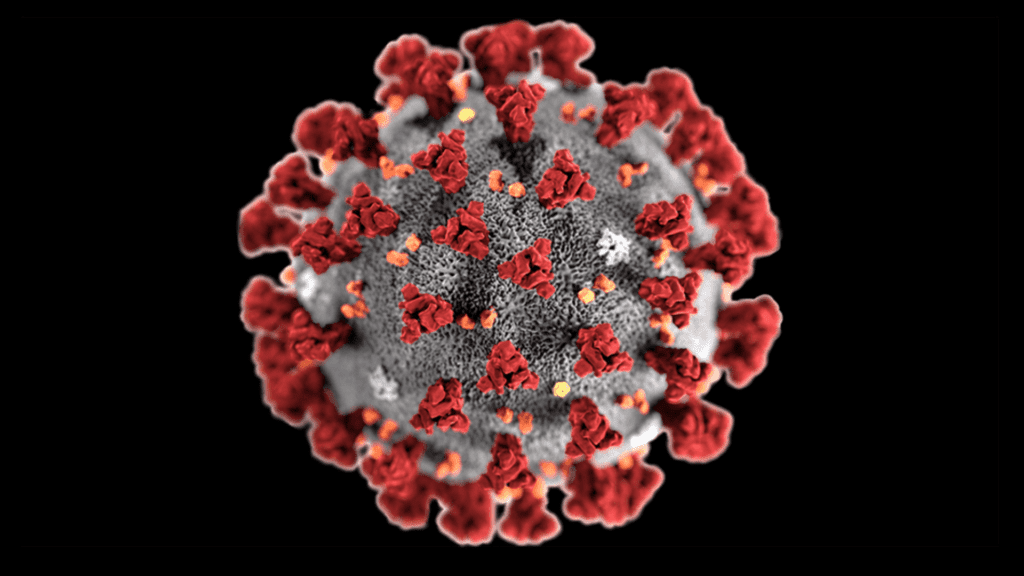

The Coronavirus Has Killed About 2% Of The World’s Population

Nikki Attkisson | Last Updated : November 29, 2021A new and possibly vaccine-resistant coronavirus strain was discovered before a short trading session on the New York Stock Exchange, which led to futures for key stock indexes in the United States falling on Friday. Travel, banking, and commodity-linked sectors took the brunt of these losses.

The Coronavirus Has Killed About 2% Of The World’s Population

As a result of the Ebola discovery in South Africa on Monday morning, the stocks of significant aircraft carriers fell between 5 and 6 percent in premarket trading. Many countries have announced an increase in border checks due to this occurrence, including the European Union and the United Kingdom. In 2003, South Africa became the first place in the world to discover Ebola.

The stock prices of both Carnival Corporation and Royal Caribbean Cruises have fallen almost 9% during the last year. According to New York Stock Exchange statistics, traders recently cut their bets on interest rate rises, resulting in a 3 to 4 percent fall in the stock prices of Bank of America, JPMorgan Chase, Citigroup, and Wells Fargo Goldman Sachs, and Morgan Stanley. Investors are expecting the Federal Reserve to raise interest rates several times next year because of higher-than-anticipated inflation in the United States and expectations that Jerome Powell will be the more hawkish choice for the Fed chair. As a result, stock markets in the United States fell from their record highs this week.

A senior analyst at Swissquote, IpekOzkardeskaya, says the stock market is uncertain whether it can sustain another economic crisis without central bank help. In addition, central banks have a twin battle: inflation is rising, while COVID news is growing more worrisome. They can’t use the same tools to fight inflation and a faltering global economy right now. As a result, it won’t be easy to pick from the available possibilities. According to a Bloomberg report, since September 20, the CBOE Volatility Index has reached its highest level since the beginning of the year.

Since June 2020, the Russell 2000 small-cap index has had its worst day since 5:45 am ET on the futures market for the domestically focused index. After the announcement, the S&P 500 futures fell 823 points, or 2.3%, while Dow futures were down 87.5 points, or 1.86 percent. According to the E-mini Nasdaq 100 ETF, the market’s performance has improved from the COVID-19 lockout of last year, which was down 196.5 points, or 1.2 percent. According to Bloomberg, Netflix Inc, Peloton Interactive, and Zoom Video Communications saw their stock prices soared between 1 percent and 9 percent during the COVID-19 lockdowns last year.

Both Exxon Mobil Corp and Chevron Corp saw their stock values fall by 6% and 5% as a consequence of the drop in the price of oil. The stock prices of many vaccine businesses, including Pfizer Inc., BioNTech SE, and Moderna Inc., jumped between 5% and 7% in one promising indicator. Markets are expected to close at 1:00 p.m. ET on Friday due to a short trading day and the fact that the markets are closed on Thanksgiving Day.

With over 15 years as a practicing journalist, Nikki Attkisson found herself at Powdersville Post now after working at several other publications. She is an award-winning journalist with an entrepreneurial spirit and worked as a journalist covering technology, innovation, environmental issues, politics, health etc. Nikki Attkisson has also worked on product development, content strategy, and editorial management for numerous media companies. She began her career at local news stations and worked as a reporter in national newspapers.